In a 8:1 verdict, a nine-judge Supreme Court Constitution bench held on Thursday that royalty payable on minerals is "not tax". The Supreme Court majority verdict held that states have legislative competence to impose tax on mines and minerals-bearing lands under the Constitution.

'Royalty Payable On Minerals Not Tax': SC Says States Can Impose Tax On Mines, Mineral-Bearing Lands

A majority verdict said that the 1989 judgment of its seven-judge Constitution bench, which held that royalty on minerals is tax, is incorrect.

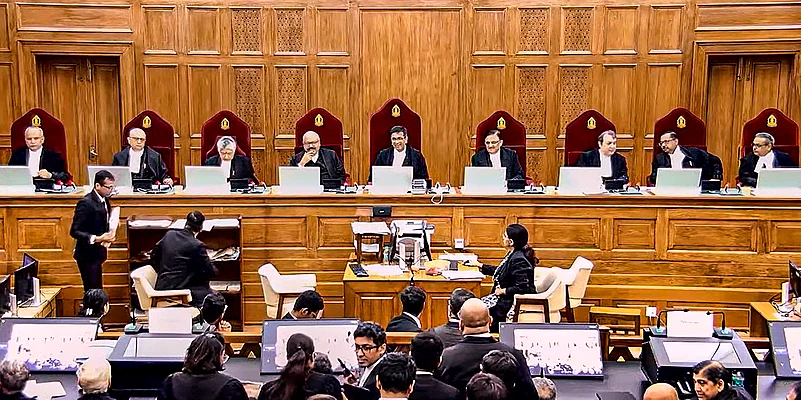

The nine-judge bench which delivered the judgement was headed by CJI DY Chandrachud and comprised Justices Hrishikesh Roy, Abhay Oka, BV Nagarathna, JB Pardiwala, Manoj Misra, Ujjal Bhuyan, SC Sharma and AG Masih.

Chief Justice of India (CJI) DY Chandrachud said Justice BV Nagarathna delivered a dissenting verdict on whether royalty payable on minerals is tax.

The majority verdict said that the 1989 judgment of its seven-judge Constitution bench, which held that royalty on minerals is tax, is incorrect.

Justice BV Nagarathna said states do not have legislative competence to levy tax on mines and minerals-bearing lands.

Royalty On Minerals | SC Majority Judgment

According to LiveLaw, the key questions that the court examined were - whether royalties on mining leases be considered as tax and whether the states have the power to levy royalty/tax on mineral rights after the enactment of Parliamentary law Mines and Minerals (Development and Regulation) Act 1957.

Chief Justice D Y Chandrachud, who read out the verdict for himself and seven judges of the bench, held that Parliament does not have the power to tax mineral rights under Entry 50 of the List II of the Constitution.

Entry 50 of List II of the Constitution pertains to taxes on mineral rights subject to any limitations imposed by Parliament by law relating to mineral development.

As per the conclusions of the majority judgment, "Royalty is not within the nature of tax as it is a contractual consideration paid by the lesssee under the mining lease. Both royalty and dead rent do not fulfil the characteristics of tax. The judgment in India Cements holding royalty to be a tax is overruled."

"There is no specific provision in the MMDR Act imposing limitations on the taxing powers of the State. Royalty under S.9 of the MMDR Act is not in the nature of a tax," LiveLaw cited the majority judgment.

The Mines and Minerals (Development and Regulation) Act (MMDR) is an Act of Parliament enacted to regulate the mining sector in India.

The majority judgment concluded that yield of mineral-bearing land can be used as a measure to tax mineral-bearing lands, adding that mineral value or mineral produce can be used as a measure to levy tax on mineral-bearing lands.

What Did Dissenting Judge Say

Justice Nagarthna, disagreeing with the majority, held that royalty is in the nature of a tax. Hence, the provisions of the MMDR Act regarding levy of royalty take away states' power to levy taxes on minerals.

Justice Nagarathna said that allowing states to levy taxes on minerals would lead to a lack of uniformity on a national resource. This could also lead to unhealthy competition among the States. This may result in the breakdown of the federal system

Meanwhile, states sought clarification from the Supreme Court on the recovery of taxes levied by Centre on mines and minerals till date on them. The Centre urged the top court to make prospective its verdict that held states power to levy tax on mines and minerals.

The Supreme Court said it will consider on July 31 issue of recovery of taxes levied by Centre till date on mines and minerals.

-

Previous Story

Gurugram: SUV On Wrong Side Kills 23-Year-Old Biker; Row Erupts As Accused Gets Quick Bail | Details

Gurugram: SUV On Wrong Side Kills 23-Year-Old Biker; Row Erupts As Accused Gets Quick Bail | Details - Next Story